How to Set Up Direct Deposit for Employees

In this article, you will learn about a Step-by-Step Guide on How to Set Up Direct Deposit for Your Employees

5 min read

Setting up direct deposit is an essential task for any business that wants to streamline its payroll process and ensure timely, error-free payments to employees. Implementing direct deposit can significantly enhance your payroll’s reliability. Studies show that 82% of U.S. workers receive their pay through direct deposit, and its popularity is growing due to the convenience it offers both employers and employees.

Establishing a direct deposit system can save time and resources, reduce paper usage, and promote employee satisfaction. Research by NACHA, the Electronic Payments Association, indicates that direct deposit can save employers up to $176 per employee annually due to reduced costs associated with paper checks.

IN this post, we’ll walk through the process of setting up direct deposit in your organization. We’ll cover everything from understanding what direct deposit is, to the benefits, necessary documentation, selecting a payment processor, and training employees. By following these steps, you’ll ensure a seamless transition to a more efficient payroll system.

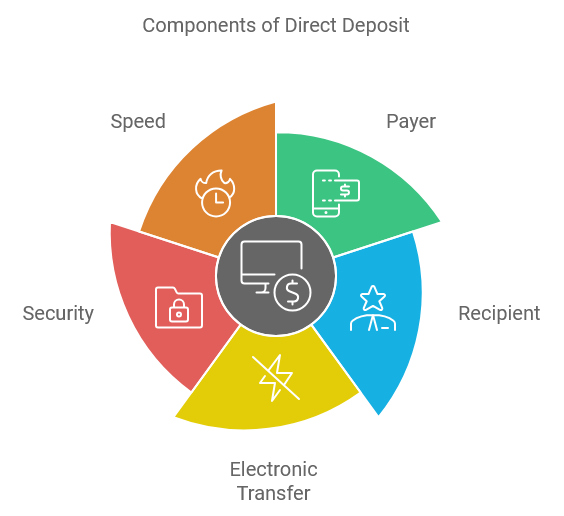

Understanding Direct Deposit

Direct deposit is a method of payment where funds are electronically transferred from the payer’s account to the recipient’s account. In this case, the payer is your company, and the recipients are your employees. This digital transaction replaces physical checks, offering a quicker and more secure way to handle payroll.

Pro Tip

Make sure to explain the concept of direct deposit clearly to your employees to answer any initial questions they might have about the process.

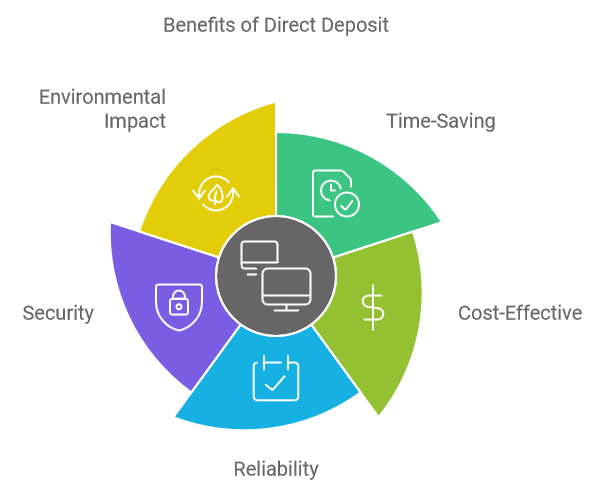

Benefits of Setting Up Direct Deposit

Setting up direct deposit offers numerous advantages. Here are a few significant benefits:

- Time-Saving: Automates the payroll process, reducing the time spent on manual tasks.

- Cost-Effective: Cuts down expenses related to printing and delivering paper checks.

- Reliability: Ensures timely payment to employees, improving employee satisfaction.

- Security: Reduces the risk of lost or stolen checks.

- Environmental Impact: Decreases paper usage, promoting a more sustainable operation.

Pro Tip

Highlight the security benefits to reassure employees who might be concerned about the safety of direct deposit.

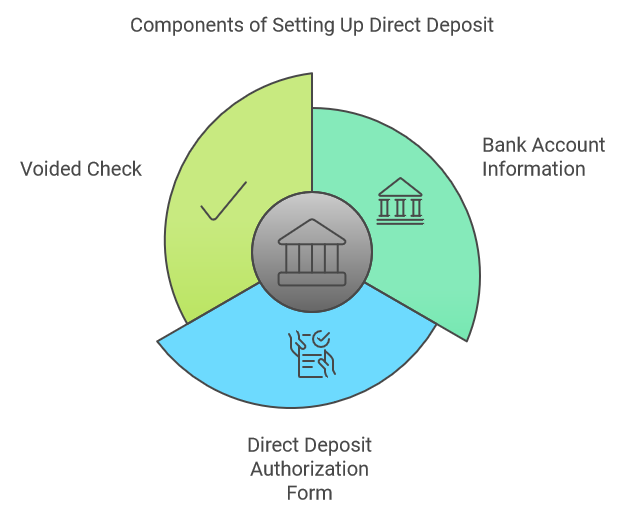

Collecting the Necessary Documentation for Setting Up Direct Deposit

To set up direct deposit, you will need specific information from your employees:

- Bank Account Information: Includes the bank name, account number, and routing number.

- Direct Deposit Authorization Form: A signed form where the employee consents to the direct deposit and provides the necessary banking details.

- Voided Check: A voided check often accompanies the authorization form to ensure the accuracy of the bank details.

Pro Tip

Create a centralized, secure system for collecting and storing employee banking information to ensure their data privacy.

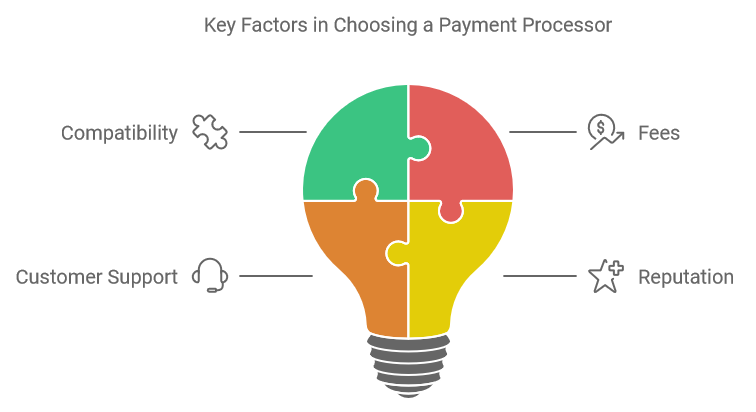

Selecting a Payment Processor for Direct Deposit

Choosing the right payment processor is crucial for an efficient direct deposit system. Consider the following factors:

- Compatibility: Ensure the processor integrates with your current payroll software.

- Fees: Compare the fees associated with different processors to find a cost-effective solution.

- Customer Support: Opt for a processor with a reliable customer support team to help resolve any issues quickly.

- Reputation: Check reviews and seek recommendations to choose a trusted provider.

Pro Tip

Conduct a pilot test with a small group of employees before rolling out the direct deposit system company-wide to identify and resolve any potential issues.

Implementing the Direct Deposit System in Your Business

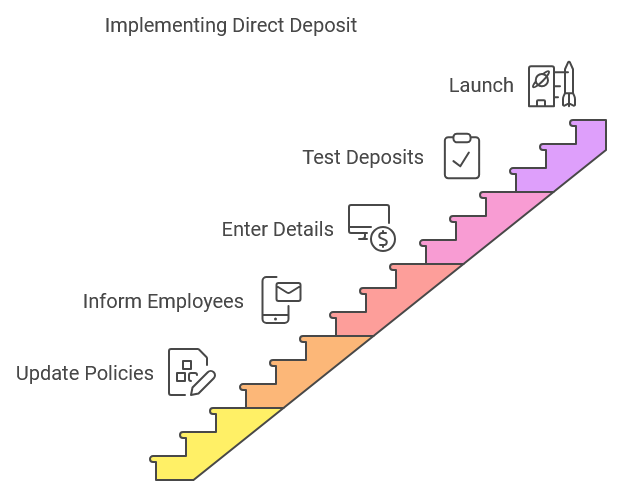

Once you’ve selected a payment processor and collected the necessary documentation, follow these steps to implement direct deposit:

- Update Payroll Policies: Include direct deposit in your payroll policy and communicate this to all employees.

- Inform Employees: Provide clear instructions and support materials detailing how direct deposit works.

- Enter Employee Details: Input the employee’s banking information into the payroll software.

- Test Deposits: Conduct a test run, known as a pre-notification or prenote, to ensure the banking details are correct.

- Launch: Once the test deposits confirm accuracy, launch full-scale direct deposit for all employees.

Pro Tip

Maintain open communication with employees throughout the implementation process. Address any concerns or issues promptly to ensure a smooth transition.

Training and Supporting Employees

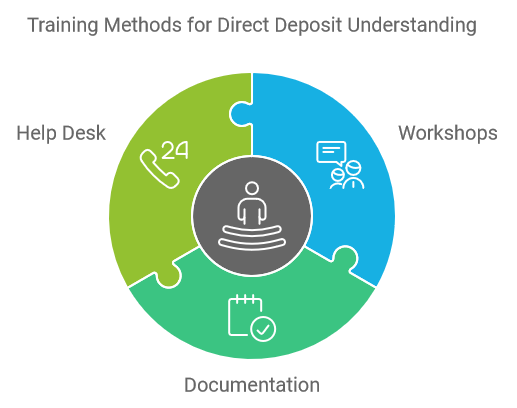

Training is crucial to ensure employees understand the direct deposit process. Consider the following training methods:

- Workshops: Hold workshops or informational sessions to educate employees about direct deposit and its benefits.

- Documentation: Provide detailed written guides and FAQs that employees can reference.

- Help Desk: Create a help desk or support line for employees to call with any questions or issues.

Pro Tip

Use visual aids and real-world examples during training to make the concepts easier to understand.

Regularly Review and Update Your Direct Deposit System

Once your direct deposit system is up and running, it’s essential to periodically review and update it to ensure continued efficiency and security:

- Audit Regularly: Perform regular audits to check for errors or discrepancies in the payroll process.

- Stay Updated: Keep up with any changes in banking regulations and update your processes accordingly.

- Employee Feedback: Solicit feedback from employees to identify areas for improvement and ensure their satisfaction with the system.

- Training Refreshers: Conduct periodic refresher training sessions to keep employees informed about any changes or updates.

Pro Tip

Use feedback from audits and employee suggestions to continuously improve your direct deposit system, ensuring it remains secure and efficient.,

In conclusion, setting up direct deposit for your employees can significantly enhance the efficiency and reliability of your payroll process, benefiting both the company and its workforce. By understanding what direct deposit entails, collecting the necessary documentation, selecting an appropriate payment processor, and implementing and training employees effectively, you can streamline your payroll operations and enjoy the many advantages that direct deposit offers.

Remember, a smooth payroll process translates to satisfied employees, and in turn, leads to higher retention rates and better overall performance for your call center or BPO. By following these steps, you'll be well on your way to achieving a more efficient and effective payroll system.

Start your outsourcing company’s transformation today!

Say hello to productivity, accuracy, and profitable growth. Streamline your operations and project management with HiveDesk.