How to pay your remote workers on your virtual team

6 min read

Looking for a quick and cost effective way to pay your remote employees quickly and cost effectively?

We have been helping remote employers keep track of work done by their employees and contractors so they can pay them correctly. We talked to our customers about the best ways to pay remote employees.

Paying your remote workers on time and accurately builds a positive reputation and helps you attract better employees.

In this post, we share cost-effective ways to pay remote employees.

Remote employees and virtual assistants may charge for their work by the hour or on a monthly retainer basis. If you pay a fixed salary or retainer, you can skip step 2 as it deals with hourly payments.

Step 1: Negotiate payment to remote workers

How much you pay your remote employees depends on the type of work and their location. If the remote employee is in the US, then you should expect to pay between $20 to $80 per hour depending on experience level and the tasks performed. If the employee is in a low-cost location such as India or the Philippines, you can expect to pay between $5-30 depending on the work.

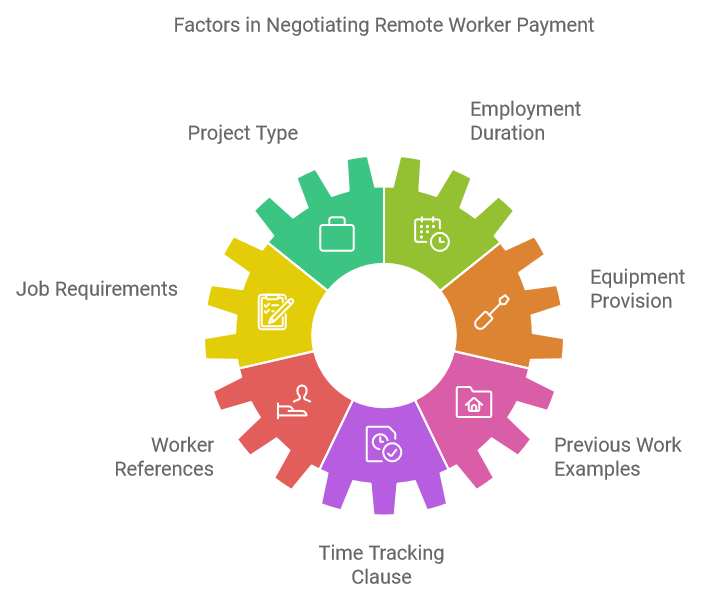

You’ll want to negotiate the pay rate with your remote workers based on:

- Is this a one-time project, like the creation of a logo or brochure?

- Are you hiring someone for the long-term?

- What is the job that needs to get done?

- Does your remote employee have his/her own equipment or do you need to provide it?

- What references can your worker provide?

- What other projects like yours has this remote worker completed? Can you see examples?

When hiring hourly employees, add a clause in their contract that you will use a time tracking software. Make it clear that you will use the timesheet from the software for paying the employee.

Step 2: Keep track of hours with hourly remote workers

You need to keep track of hours worked each month to pay them correctly. An automatic online time tracking software is the most efficient and practical way for keeping track of employees’ time.

The software records how long each employee works and generates an automatic timesheet. You can generate automatic payroll or the amount owed to each employee if you enter the hourly pay rate in the software.

Step 3: Handling remote employee billing

A remote contractor will bill you at the end of the pay period. You will verify the billed amount and the work description to make sure you are paying the correct amount.

It’s straight forward for employees on a retainer as the only thing you need to verify is the work done in the month.

The hourly employees should submit invoices with the following information:

- Worker’s name, contact information, and the date

- Number of hours worked for you and the tasks performed

- Dollars per hour charged

- Amount owed to the worker

- Terms of payment, i.e., 14 days within receipt of invoice

You should verify the invoice from hourly contractors with the timesheet from your time tracking software. In case of discrepancy, the software data should prevail as it’s more accurate.

Sometimes, a new remote worker may require partial payment upfront (called advance payment) before he starts the work. Don’t be alarmed by it; it’s pretty common. After that advance, you’ll pay your remote workers off of timesheets or the invoices they submit to you.

Step 4: Paying your remote employees

You can use many online payment platforms to pay your remote workers easily and at very low cost. Two of the most popular platforms for paying remote workers are:

- PayPal

As one of the very first online payment platforms on the Internet, PayPal is a trusted way to send payment to anyone–for remote work or not.It’s the biggest online payment platform that works in most parts of the world. It supports multiple currencies so you can pay remote workers in any country. You can through your bank account or credit card.

PayPal charges the receiver a low fee as a percentage of the transaction value. But that small percentage can become a big dollar figure if the bill is in thousands of dollars. Your remote workers will pay Paypal the transaction fee for transferring the funds to their bank account.

The employee may lose additional money on currency conversion if the remote worker is in a different country. PayPal pays a lower exchange rate than banks so that’s more money lost by the worker.

This means either the remote employee gets less than what you paid or you pay extra to cover the PayPal fee.

PayPal sometimes puts hold on accounts without warning. This is another irritant for the employees.

PayPal is a favored tool for paying remote workers because it’s easy to use and works in most countries.

- Wise (Earlier called TransferWise)

Wise is perhaps the second most popular but least expensive way to pay remote workers. If you’re looking for the perfect money transfer service to workers in other countries, this is it. And it won’t burn a hole in your or your remote employee’s pocket.Its biggest advantage is its low fee and high close to real exchange rate. That’s the major reason many businesses use Transferwise to pay remote workers who live in a different country.

Here is how it works:

- Both you and your employee set up a free account, connect a bank account, and verify your identity

- You log in to the account and initiate payment.

- Wise transfers money to your employees’ bank account at the best currency exchange rate

Wise charges 41 cents for every transfer plus 0.5% of the amount sent. But it still works out better than PayPal because it offers a better exchange rate.

Wise has a bank account in every country it operates in. When you send money, you transfer the money from your account to Wise’s account in your country. Wise then sends the equivalent money at the current exchange rate from its account in the receiving country to the employee’s account.

Since the money never crosses country borders, it’s faster and cheaper.

Users only need to pay for its conversion fees and mid-market exchange rates. It works by converting your cash at a mid-market rate, with transaction fees taken out before the conversion. It supports over 300 different currencies. Its main drawback is that it’s not available in every country. But if you don’t want to pay high fees and live in a place serviced by Wise, then you’re better off using it over PayPal.

How to pay remote workers in India?

As companies continue to hire remote workers globally, the issue of how to pay remote workers in India has become increasingly important. India is perhaps the largest supplier of remote workers for US businesses.

India has specific foreign exchange laws that control payments to employees and businesses in India. It’s crucial for companies to understand the best practices for compensating their remote workforce in India.

One option is to use an electronic payment platform such as PayPal, Payoneer or Wise that allows for easy and secure transfers of funds. This is usually the fastest and cheapest mode of paying remote employees in India. Wise offers a better currency conversion rate so many professionals in India prefer Wise over PayPal and bank transfers.

The other option is to wire transfer the money from your bank to the remote worker’s bank in India. This requires setting up wire transfer with your bank. You’ll need the remote employee’s bank details and SWIFT code to transfer the money. Wire transfers are expensive, starting at around $40 for each transfer. It takes 3-4 days for the worker to receive money in the Indian bank account.

It’s always good to inform the employees when you initiate the payment and check with them in 1-2 days to make sure they received the money.

You should also stay up to date on changes in Indian and US laws and regulations to ensure compliance and avoid any legal issues.

How to pay contractors in India?

When it comes to paying contractors in India, it is important to first understand the legal and regulatory requirements. Generally, payments can be made via wire transfer or check, and it is recommended to obtain a receipt of payment for record-keeping purposes.

Additionally, it is important to ensure that all taxes and legal compliance requirements are met, as failure to do so can result in penalties and legal issues. It is also advisable to establish clear payment terms and timelines in the contract to avoid potential disputes or miscommunications.

Overall, paying contractors in India requires careful attention to detail and adherence to legal procedures to ensure smooth and lawful business operations.

What payroll deductions employers are required to make in India?

In India, employers are required to make a variety of payroll deductions from their employees’ salaries. These deductions include income tax, employed provident fund (EPF), professional tax, and health insurance contributions.

Income tax is based on the employee’s income and is mandatory for all salaried individuals. The EPF deduction is contributed by the employer and employee and goes towards a retirement fund. Professional tax is a state-level tax that varies by state and is mandatory for all salaried individuals. Health insurance contributions are also mandatory for salaries below a threshold decided by the central government. The contribution goes towards the employee’s health insurance policy.

Employers must ensure that these deductions are made accurately and in a timely manner to avoid any legal penalties.

How to pay remote employees locally vs. internationally?

Many US businesses have remote employees in the US as well as outside the country.

Paying local remote workers is simpler compared to paying internationally. You pay local in the US via bank or payment services like PayPal. You will need to make sure that you’re compliant with the federal and state laws. Paying locally can simplify the payment process and ensure compliance with local tax laws. However, it may limit your ability to attract and retain top talent from around the world.

On the other hand, paying internationally can provide access to a wider pool of talent and potentially lower labor costs. But it can also introduce additional challenges, such as managing currency exchange rates and complying with international tax laws.

When should you pay remote workers?

It’s important to establish a clear and fair payment schedule for your remote workers. You should sign a contract that clearly lays out the payment schedule and what the basis of the payment.

For example, if you’re paying by the hour, the contract should lay out the hourly pay rate in your currency and how many hours the worker is allowed to bill you in a week or month. For international payments, it makes sense to pay employees once a month unless the local labor laws require otherwise. International payments involve a fee for each transfer, so you want to minimize the number of transactions. If the remote worker is in the US, you should probably pay them bi-weekly.

If you plan to pay based on the output, the contract should clearly specify the output and how you will measure it. For example, you may deice to pay an SEO specialist by the number of backlinks added. The contract should clearly specify which backlinks you’ll accept as genuine.

Make sure that the remote worker invoices you correctly before you pay the person. This is very important for proper accounting, as your accountant will need to reconcile payments against the invoices. You should pay the worker within 1-2 days of receiving a valid invoice.

Make sure that you make any legal deductions you are required to make.

How to calculate employer and employee contributions for remote workers?

Calculating employer and employee contributions for remote workers can be challenging. Employers must consider factors such as the state and local taxes of the remote worker’s location, the type of benefits they are offering, and the employee’s salary.

To calculate the employer’s contribution, they must first determine the total cost of the benefits offered to the remote worker. Once that is determined, the employer can then allocate that cost based on the percentage of the employee’s salary.

For employee contributions, employers must consider the employee’s taxable income, the cost of benefits, and the employee’s contribution rate. Accurately calculating contributions for remote workers requires careful consideration and an understanding of the relevant tax laws and regulations.

Do remote workers get tax-free pay?

When it comes to remote work, many wonder if it comes with any tax benefits, specifically if remote workers get tax-free pay. Unfortunately, the answer is no.

Remote workers are still required to pay the same taxes as traditional employees, including federal and state income taxes, social security taxes, and Medicare taxes. However, remote workers may be eligible for deductions related to their work-from-home setup, such as home office expenses and internet and phone bills.

It’s important for remote workers to stay informed about their tax obligations and consult with a tax professional to ensure they are complying with all regulations.

Recap

Once fair pay rates are established and work is performed by the remote employees as expected, pay them their due. Automate the process by using reliable and affordable time tracking software. Use Transferwise or PayPal depending on your employee’s location.