How to Calculate Labor Costs in BPO: A Comprehensive Guide for Call Centers

In this article, you will learn about how to calculate labor costs in BPOs accurately using best practices, advanced technologies, and regular audits.

5 min read

How to calculate labor costs in BPO companies is a critical question for CXOs, HR managers, and operations managers.

In the fast-paced world of call centers and business process outsourcing (BPO), controlling labor costs can be the difference between profit and loss. This blog post will dive deep into the methodologies, tools, and best practices for calculating and managing labor costs effectively.

We’ll explore why it’s crucial for the sustainability and growth of BPOs. We’ll also include up-to-date statistics, references to reliable sources, and actionable tips to make your practice more efficient and precise.

Did you know that labor costs can constitute up to 70% of the total operational expenses in a BPO?

Given such a significant impact, understanding how to calculate these costs accurately is essential. High labor costs can erode profit margins, while low costs could indicate underpaid or dissatisfied employees. Balancing the equation ensures your workforce is motivated and your business remains profitable.

According to a report by Deloitte, efficient labor cost management can improve operational efficiency by up to 25%. This post will guide you step-by-step on leveraging cost calculations for better decision-making.

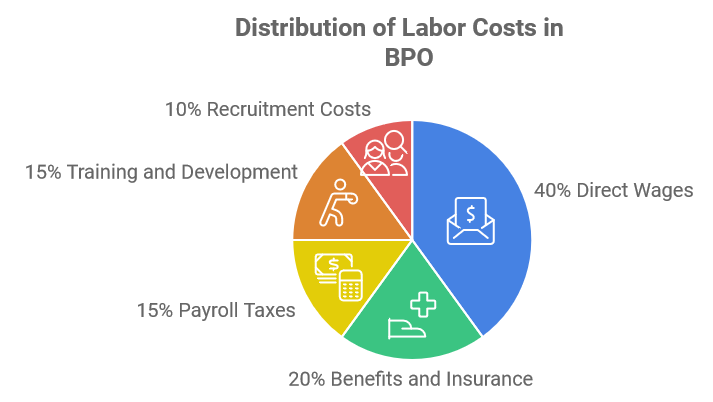

Components of Labor Costs in BPO

Understanding how to calculate labor costs in BPO begins with identifying its components. Let’s delve into these critical elements:

1. Direct Wages

Pro Tip

Use automated time-tracking software to monitor hours worked more accurately, which helps in minimizing errors and discrepancies in wage calculations.

2. Benefits and Insurance

BPOs often offer additional benefits like health insurance, retirement plans, and other perks. These costs add to your overall labor expenses. Health insurance alone can contribute to around 8-12% of total payroll costs, according to the Bureau of Labor Statistics.

Pro Tip

Negotiate with insurance providers for group insurance plans; this can significantly reduce per-employee costs.

3. Payroll Taxes

Pro Tip

Stay updated with our labor law guides for US states and countries around the world to take advantage of any possible tax credits or reductions.

4. Training and Development

Employee training and development are essential investments for the long-term success of any BPO. These costs can include onboarding training, ongoing skill development, and certification programs. While they are essential for enhancing efficiency, they also contribute to labor costs.

Pro Tip

Implement e-learning platforms to make training more scalable and cost-effective without compromising on quality.

5. Recruitment Costs

The cost of hiring new employees—advertising job openings, conducting interviews, and onboarding—adds up quickly. High turnover rates in BPOs make this a significant component of labor costs. Research by SHRM indicates that the average cost-per-hire is around $4,129.

Pro Tip

Develop a robust employee referral program to reduce recruitment costs and improve the quality of hires.

Calculating Total Labor Costs

With the core components in mind, let’s discuss the steps for calculating total labor costs:

1. Identify All Cost Components

Ensure you include all aforementioned components such as direct wages, benefits, payroll taxes, training, and recruitment costs. Missing out any can lead to inaccuracies in your calculations.

2. Use Cost Allocation Methods

Pro Tip

Use specialized software like Hivedesk for automated and accurate labor cost tracking.

3. Apply the Formula

The basic formula for calculating labor costs is:

Labor Cost = Direct Wages + Benefits + Payroll Taxes + Training Costs + Recruitment Costs

Implement this formula monthly or quarterly for regular assessments. Reportedly, 57% of CFOs believe regular cost calculations can lead to better financial planning and workforce management.

4. Monitor Contractor and Freelancer Costs

Many BPOs also engage contractors and freelancers. Their costs should be carefully tracked to avoid underestimating labor expenses. Ensure their wages, benefits, and taxes are included in your calculations.

Pro Tip

Use separate accounts in your payroll system to track freelancer payments distinctly from employee wages.

Direct vs. Indirect Labor Costs

Segregating direct and indirect labor costs offers a more granular view of labor expenses, making it easier to identify areas for improvement.

1. Direct Labor Costs

These are expenses directly tied to the delivery of services, such as wages of call center agents. Accurate direct labor cost calculations enable better pricing strategies.

Pro Tip

Regularly review direct labor costs against key performance indicators (KPIs) to optimize workforce productivity.

2. Indirect Labor Costs

These include costs related to support staff like HR, finance, and administrative personnel. Though not directly involved in service delivery, these roles are essential for smooth operations.

Pro Tip

Implement resource optimization strategies to minimize indirect labor costs without impeding operational efficiency.

Using Technology to Calculate Labor Costs

Advanced technologies have revolutionized how BPOs calculate labor costs, making the process more accurate and less time-consuming.

1. Automated Payroll Systems

Pro Tip

Integrate your payroll system with BPO time-tracking tools for real-time labor cost assessments.

2. Data Analytics Tools

Pro Tip

Invest in BI tools like Tableau or Power BI to visualize labor cost data dynamically and interactively.

3. Workforce Management Software

Workforce management tools assist in employee scheduling, attendance tracking, and compliance management. Implementing a robust workforce management solution ensures better control over labor costs.

Pro Tip

Choose software that offers reports to forecast labor demands and avoid overstaffing or understaffing.

Importance of Regular Audits

Frequent audits are essential for maintaining accuracy in labor cost calculations and identifying areas for improvement.

1. Schedule Periodic Reviews

Conduct monthly or quarterly reviews to ensure that all components are correctly accounted for. Regular updates can catch discrepancies early.

2. Engage External Auditors

External audits provide an impartial review of your labor cost calculations, ensuring compliance and accuracy.

Pro Tip

Establish a relationship with a reliable accounting firm for regular external audits.

3. Implement Internal Control Mechanisms

Develop and implement internal control mechanisms to monitor labor costs continuously. Automated alerts on irregularities can prompt timely interventions.

Pro Tip

Use audit software like AuditBoard or TeamMate for comprehensive internal control management.

Conclusion

Understanding how to calculate labor costs in BPO accurately is essential for efficient operations and sustained profitability.

By breaking down the components and adopting the latest technologies, you can ensure precise cost calculations. Remember, regular audits and effective cost allocation methods will further enhance your financial management capabilities.

Use this guide to optimize your labor cost calculations and drive your BPO towards greater efficiency and profitability.

User this guide to also understand how these calculations align with your overall business strategy and make informed decisions that benefit your organization in the long run. Implement these improving steps today to see a marked difference in your bottom line.

Pro Tip

Regularly revisiting and updating your calculation methodologies will help you stay competitive in the dynamic BPO sector.